The ol' Bloviator requires neither the calendar nor his annual torment in pollen hell to clue him in to the season. No sir, the unmistakable constriction in his hind parts is more than sufficient to remind him that it is mid-April once more and time to open the old checkbook and let Uncle Sam have his way with it yet again. The atmosphere of this season of not exactly joyous giving seems almost superheated this year, what with the ongoing debate in Washington about tax reform, the new budget, and what is to be done about the gaping, gargantuan deficit that threatens not only to undermine our short-term prospects for economic recovery, but effectively cripple generations of Americans stretching far into the future. The S & P's recent hint that we may be on our way to becoming the world's largest issuer of junk bonds speaks volumes about the absolute urgency of beginning immediately to reduce government spending. Getting the hell out of Iraq and Afghanistan would be a great way to start, but entitlement programs clearly have to be on the table as well. The latter admonition is aimed, by the way, not at the bleeding heart lefties but at the 70 percent of Tea-Baggers who claim to be such deficit hawks, but when polled opposed any cuts to Medicare and Medicaid, the single biggest budget-drainers we have.

As if our political environment were not polarized enough, here come more charges that the uber-rich contribute too little to our national coffers, to be followed, almost certainly, by counter complaints that the reverse is true, especially since nearly half of American households pay no income taxes whatsoever. The precipitant for this latest firefight is a new report based on IRS tax-return data revealing that in 2007 an American earning $500 a week paid 22 percent of that modest sum back to the feds, while another who earned $1 million a day wound up forking over only 16.6 percent of his or her slightly more substantial take.

In 2007 the top 400

households in the country averaged some $345 million in annual income as

compared to a mere $47 million in 1992. In case you're interested, that's an

inflation-adjusted increase of 399 percent. Over the same period, the effective

tax rate on this highly select bunch dropped from 26.4 percent to 16.6, with

only 33 of the top 400 paying taxes at the max rate of 30 to 35 percent. Part

of the reason for this apparent discrepancy is the fact that while the payroll

taxes paid by this group were too miniscule to matter, capital gains, which are

only taxed at 15 percent, accounted for two-thirds of the top 400's haul in 2007

as compared to scarcely one-third in 1992. (By way of perspective, households

in income percentiles 95-99 ($255k-$451k) paid an additional 1 percent of their

incomes in taxes compared to the swells up at the very tippy-top.) Keep in

mind, of course, that these numbers are for 2007, when capital gains were a lot

higher than they likely would be after we tumbled into the current financial sinkhole.

There is also the very real fact that, even when paying at a comparatively lower effective tax rate, in 2008 the top 1 percent of taxpayers (above $383k) accounted for 20 percent of the adjusted gross income reported nationally but 38 percent of all federal income taxes collected. Meanwhile, the bottom 50 percent (below $33k.) received 13 percent of the income and paid but 3.0 percent of the federal income taxes. Moreover, roughly nine in ten of these bottom-halfers paid no federal income tax at all.

A lot of the misunderstanding on both sides of the tax reform debate has to do with terminology. For example, it is important to differentiate between the 45 to 47 percent of American households who pay no income taxes and the roughly 10 percent who pay no federal taxes whatsoever. Three-fourths of American workers actually fork over more in federal payroll taxes, i.e., Social Security and Medicare, than in income taxes. Certainly, it may be argued that these payments are merely fractional downpayments on deferred benefits, but take it from somebody who has been doing this for a while, there is certainly no guarantee that the benefits ultimately received will equal or exceed what an individual worker has contributed.

There is also the use of percentages, which can skew perceptions of how much (or little) one income group actually pays in comparison with another and also distract us from the importance of income absolutes, which means that even if, as a group, the super-rich are footing a disproportionate share of the aggregate national tax burden, as individuals they are still paying taxes at well below the rate that would be required to crimp their styles in the least. Recall from above that while 1 percent of all the people who filed a federal tax return in 2008 showed an adjusted gross income of more than $383, 000, 50 percent--That's right, one-half!--reported adjusted incomes less than $33,000. So, in the off chance you've never thought of it, there is one hellaciously big difference between what's left after paying 20 percent of $33,000 as opposed to 20 percent of $383,000.

Even in the best case

scenario, restoring even the historically steepest tax rates of 90 percent on the really high

rollers isn't going to solve the deficit problem in and of itself, and the OB acknowledges that, in actual practice, jacking up their

taxes (which are now the lowest they've been since 1929--Does that date ring a

bell?) will simply spur them to sink more money in tax-avoidance schemes and

devices. He does not, however, give the least bit of credence--let him make it

abundantly clear here, he means not the least bit--to the notion (embraced in the 1920s by the

Coolidge/Hoover crowd who gave us the Great Depression and resurrected in 1980

by Ronald Reagan) that the spending and

investment benefits of cutting taxes on

the rich will "trickle down" to the folks at the bottom of the economic

pyramid. First of all, I got a flash for

you! If you're making $345 million a year, the chances are pretty good that, in

addition to the entire contents of the Brookstone and Hammacher-Schlemmer

catalogues, you already have all the oversized and over-decorated houses, ridiculously

expensive automobiles, and ostentatious mega-yachts you want; so your consumer

spending is typically not going to turn out to be the equivalent of a private

mini-stimulus bill. If there were a means to guarantee that the tax savings on

ultra-high incomes could be channeled directly to investments guaranteed to

produce more and better jobs and expand opportunities across the board, the OB

might be willing to give that strategy a

shot. Let's face it, however, whether your objective is becoming ridiculously

rich or simply edging into the upper middle class, as America's identity as the

world's greatest producer nation has gone straight into the toilet over the

last generation or so, the key to accumulating wealth for a large swatch of our

population has been buying and selling paper to which there is supposedly some

financial value attached. This is precisely why "hedge-fund manager" and "filthy

rich" have become well-nigh synonymous. Corporations have frequently enhanced

the attraction of their "paper" for those with the highest disposable incomes

by cutting back on payroll costs, either by further mechanizing, downsizing, or

transferring jobs and facilities to more profitable operating environments

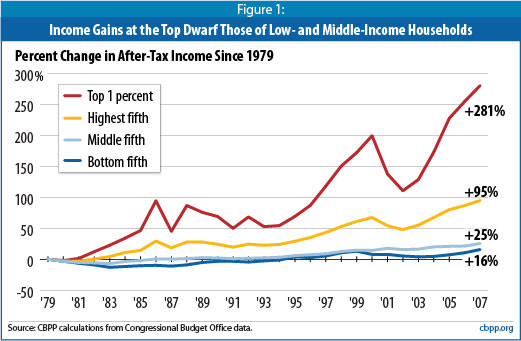

beyond our borders. In short, as the chart below indicates, much as they did in

the 1920s, during and since the Reagan era, tax cuts for the rich have done

nothing more than exacerbate already extreme disparities in wealth, while the

average American household has seen its income grow to the dispiriting tune of

one-third of one percent annually.

The OB has little patience either with the whining of people whose tax bills amount to little more than pocket change, or lifetime support programs for people who would not work in a pie factory. He does feel though that we should be slow to take any action that would exacerbate the already strained circumstances of the substantial and regrettably growing population of the fully employed "working poor," who are quite simply doing their damnedest simply to get by. Okay, so much for the top and bottom income tiers, how about the folks in what is a very sizable middle, which the OB guesses, includes him and the Missus? In fact, it's good that you asked, because the OB is willing to offer the Bloviator Household not necessarily as representative, but at least as a case in point to suggest that there are probably a good number of folks in the supposedly suffering middle-class who may not really be suffering all that much. As empty-nested baby boomers with not much in the way of the standard write offs, he and Ms. OB seem to get touched up by the I.R.S. for roughly 20 percent of their adjusted shekel count every year. Writing these checks ain't the least bit enjoyable, but for all our ritualistic complaining, we are certainly thankful that we've thus far been able to keep on writin' them and not be uncertain in the least as to whence cometh our next meal or twelve-pack of Sam Adams (not necessarily in that order).

The OB's real point here--and I know you've been wondering for quite a spell now if he really had one--is that there is almost certainly a substantial group of Americans for whom a little bit of additional taxation would still be more of an irritation than an actual burden, especially if we thought our "contributions" would be complemented with legitimate spending cuts and utilized to make this country a better place not only for us and our kids but for those who would truly make the best of whatever opportunities it continues to provide. For example, the aforementioned poll shows that even 45 percent of the rabidly tax-averse Tea-Baggers, not to mention 43 percent of Republicans overall and a whopping 63 percent of Independents think it might be OK for Uncle Sam to take a little bigger bite out of those with incomes above $250,000. Unfortunately politicians seldom make the effort to distinguish between what their constituents prefer and what they will accept. Thus, with neither the moral credentials nor the moral courage to exhort us as a people to listen to, as Lincoln put it, the "better angels of our nature, " our would-be leaders of all stripes can offer only the narrowly self-serving politics of exaggerated grievance and ill-concealed greed that already lies at the center of the current impasse.